Hey folks,

For over a decade, Bitcoin moved slowly. Secure, reliable, and famously conservative.

But 2025 feels different.

If 2023 was the year of ordinals, and 2024 was the year of Bitcoin ETFs, 2025 is the year Bitcoin scaling finally went mainstream.

The oldest network in crypto is moving beyond “digital gold” toward real programmability, and serious capital is now building around it.

This isn’t hype.

This is Bitcoin growing up.

The Bitcoin L2 boom: Why it matters

Bitcoin’s base layer handles security better than anything else in crypto, but it can’t run complex apps. That’s where L2 networks come in. They add smart contracts, DeFi, fast payments, NFTs, and rollup-style systems on top of Bitcoin, while settling back to the main chain.

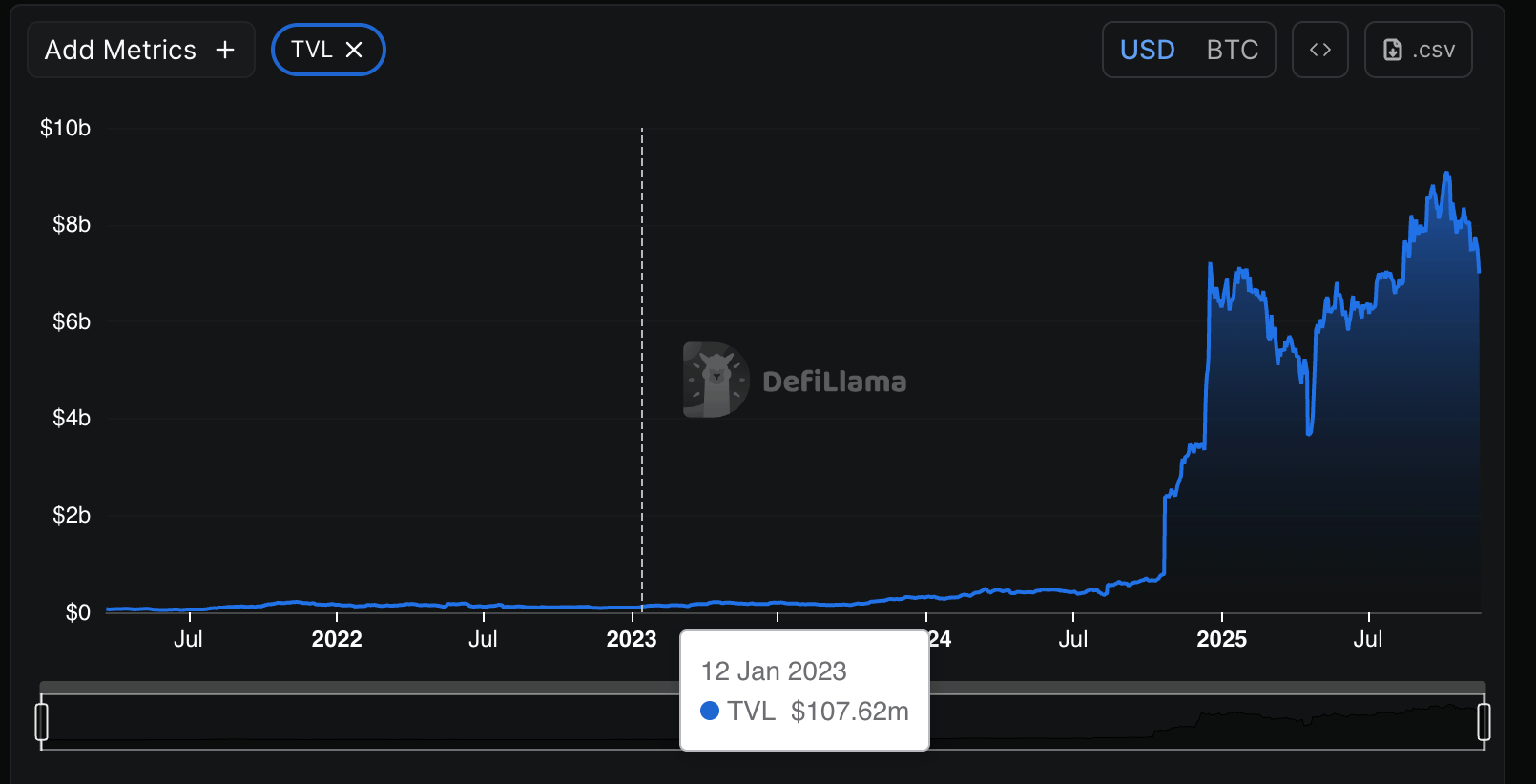

And the shift is visible in the numbers.

In early 2023, Bitcoin L2s and BTCFi platforms held only a few hundred million dollars in TVL.

Bitcoin historical TVL in DeFi (Source: DeFiLlama)

As of November 17, 2025, the broader ecosystem sits above $5b in TVL, and depending on which projects you include, the number approaches the $7b mark on DeFiLlama.

This is the fastest expansion Bitcoin has seen since Lightning’s early years.

Why is everyone suddenly talking about Bitcoin L2s

Bitcoin security meets Ethereum-style flexibility

Stacks, Rootstock, emerging BitVM-based designs, and projects like Citrea are pushing smart contract capability to Bitcoin.

Stacks uses Clarity for predictable smart contracts. Rootstock brings EVM compatibility. Citrea is rolling out a ZK system that settles to Bitcoin. BitVM research is making rollup-style proofs possible without modifying Bitcoin itself.

Together, they form a smart contract environment anchored to Bitcoin’s settlement strength.

Ordinals created demand, and L2s are building the solutions

Ordinals demonstrated overwhelming user demand for NFTs and tokens on Bitcoin by sparking millions of inscriptions, pushing Bitcoin fees to multi-year highs.

The surge in activity highlighted both the appetite for Bitcoin-native digital assets and the limitations of the base layer.

L2s are now absorbing this activity in scalable environments while keeping Bitcoin as the settlement anchor.

Institutions are getting involved

Once spot Bitcoin ETFs were approved in 2024, inflows jumped. BlackRock’s IBIT became the fastest-growing ETF launch in US history.

With that momentum, institutions are now looking at staking-style systems, yield strategies, and infrastructure projects being built on Bitcoin L2 rails. Galaxy Digital and others are directly engaging with BTCFi platforms.

Interoperability is getting real

New bridges and rollups like Rootstock (EVM compatibility), Nomic (IBC-native BTC for Cosmos), Stacks sBTC (Bitcoin liquidity for smart-contract platforms), and Citrea (Bitcoin-settled ZK rollup) are making Bitcoin interoperable across Ethereum, Cosmos, and beyond.

Together, these projects are pulling Bitcoin into the multi-chain world.

VCs are pouring in

Major funds are investing heavily in Bitcoin scaling startups.

Paradigm participated in Babylon’s major funding round, a Bitcoin staking and security protocol enabling Bitcoin to secure PoS chains.

Botanix, the Bitcoin-based blockchain for building the financialization of Bitcoin invested in by Polychain.

Bitcoin EVM L2 network BOB completed a $10 million seed round financing, led by Castle Island Ventures

The result is the strongest builder pipeline Bitcoin has ever seen.

The builders leading the movement

Stacks (STX), a mature Bitcoin L2 with Clarity smart contracts that enables DeFi, NFTs, and apps secured by Bitcoin finality.

Lightning Network is a high-speed, low-fee micropayment network and fintech rail.

BitVM rollups are a technical approach enabling rollups on Bitcoin without altering the base layer, a potential game-changer.

Rootstock (RSK) is an EVM-compatible Bitcoin L2 with lending, bridges, and a growing app stack.

Citrea is a ZK-rollup settling to Bitcoin, one of the more anticipated launches of 2025.

Where this is headed

Ethereum was slow and expensive before rollups. Then L2s unlocked a surge in activity.

VanEck now projects that Ethereum L2s could reach a combined valuation of $1 trillion by 2030.

Bitcoin is entering that same growth curve today.

Bitcoin L2s open the door to:

decentralized exchanges secured by Bitcoin

BTC-backed stablecoins

gaming ecosystems

identity layers

fully on-chain apps that inherit Bitcoin’s settlement guarantees

If even a slice of Ethereum’s L2 activity shifts to Bitcoin, the impact would be huge.

Bitcoin is moving from digital gold to a full financial operating system.

The catch

Bitcoin L2s still have hurdles:

competing models and architectures

early-stage developer tooling

liquidity scattered across different chains

regulatory questions around bridged BTC

And Bitcoin’s conservative culture means changes take time.

But the momentum is clear. Developers are building on Bitcoin directly, not around it.

Bitcoin’s future isn’t just holding. It’s actually using it.

Lastly, stay informed, double-check sources, and DYOR as the space evolves.

The crypto market fell nearly 9% last week, with Bitcoin dropping below $100K to the $94K–$95K range after a 10% correction driven by profit-taking, slowing ETF inflows, and macro uncertainty. ETH also saw a correction, dropping over 10%, briefly retesting $3,000 before rebounding to $3,200, while altcoins like UNI, ASTER, and ZEC stood out with strong gains despite the broader market pullback.

Weekly price movement:

BTC $95,691 ⏬ 10.13% (1W)

ETH $3,199 ⏬ 11.4 % (1W)

UNI $8.05 ⏫ 19.60% (1W)

ASTER $1.22 ⏫ 8% (1W)

ZEC $683 ⏫ 1.35% (1W)

(All data here as of 1:38 p.m., 17 November 2025)

Before we conclude, here’s a quick look at some important news from around the crypto world.

Payment processor Square has launched its Bitcoin payment feature for sellers, allowing them to opt in and accept Bitcoin at checkout through its point-of-sale system. Jack Dorsey said in an X post that with the new feature, merchants using Square can receive Bitcoin to Bitcoin, Bitcoin to fiat, fiat to Bitcoin, or fiat to fiat payments, according to Cointelegraph.

A new safe harbor announced by the US Internal Revenue Service on Nov. 10 is being seen as a major step toward allowing crypto exchange-traded products (ETPs) to share staking rewards with their investors. Under certain conditions, the new guidance allows trusts to “stake their digital assets without jeopardizing their tax status as investment trusts and grantor trusts for federal income tax purposes,” according to the IRS document. (Source CoinDesk)

That’s it for now. Thanks for sticking around.

See you later, folks! 👋