The morning is indeed good with a freshly brewed cup of coffee...

Oh btw, Welcome to Switch Daily!

It is only the second day of this week but the crypto market has got no chill, like the weather in Delhi. Can Winter come already? Everyone is sweaty and sticky. I mean really, "Pooja, what’s this behavior?"

tenor

Here’s the menu for today's buffet 😋

Market Pulse…is getting weaker

Inflation sucks and so does the FOMC

Top notch news

Meme of this slightly above average day

Market pulse 📈

Crypto market dressed as the little red riding hood

The Weekend asked me to ‘Save my Tears’ cause I got a load of weeping to do given the current market conditions.

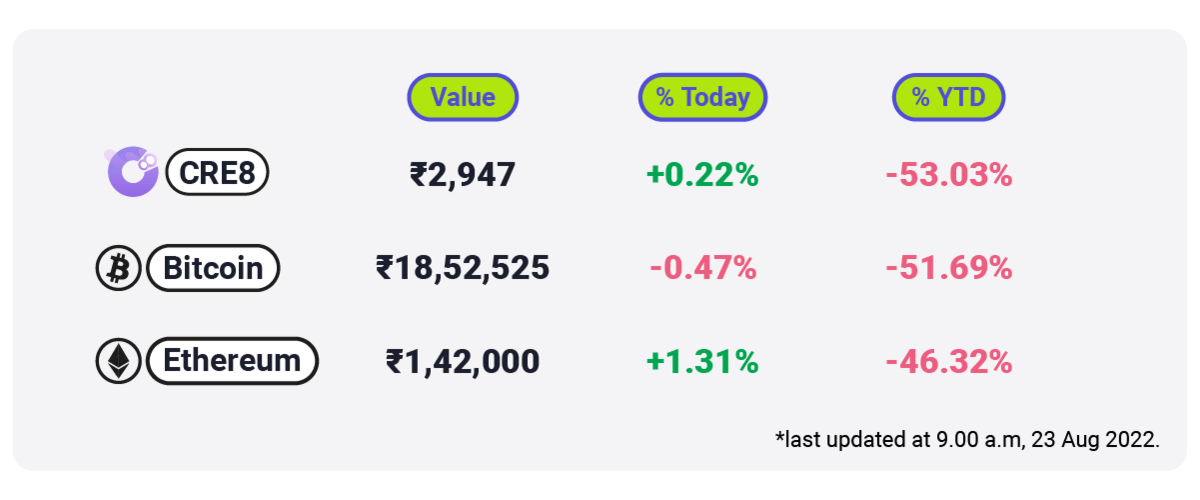

BTC along with the remaining crypto market began plummeting last week. Bitcoin stood at $21k (₹18,52,525), witnessing over 11% drop in its total market capitalization in a week’s time frame. The second largest crypto by market cap, Ethereum was also down by nearly 14% in the past 7 days, somehow keeping its head above water at the price of $1600 (₹1,42,000). The crypto community is speculating the FOMC minutes as the initial trigger for this domino downtrend.

Reasons behind the weekend crash📉

Still whining about Bitcoin's Friday fiasco? Well, get this, BTC was already dropping like it's hot, we just happened to notice it over the weekend.

Wait but what triggered it?

So, basically last week, the FOMC minutes confirmed the high likelihood of Fed hiking interest rates by another 75bps despite a slight drop in inflation this month.

FOMC? Don’t worry, we googled on your behalf : The Federal Open Market Committee (FOMC) is the US government’s watchdog for the nation’s open market operations.

The release triggered a steady downtrend across industries which eventually landed on your charts this weekend.

Subsequent to the crypto market, the equities ecosystem also witnessed a downward trajectory.

Hey, no snoozing! There is more.

The International Monetary Fund (IMF) also alerted investors about the growing correlation between crypto and Asian equity markets.

Adding to this regulatory heat against crypto across the globe, even the South Korea authorities announced a hefty gift tax on the feature of crypto airdrops.

Aur batao? 🤷♂️

Jharkhand becomes the first state to use blockchain for farmers

Jharkhand state’s Directorate of Agriculture has partnered with blockchain startup SettleMint to help distribute seeds to farmers, distributing close to 30,000 quintals of seeds to around 3 lakh farmers. Read more.

Tether quarterly data: 58% drop in commercial paper holdings

After Terra crashed, there were growing concerns about Tether’s holdings in commercial papers and its exposure to Chinese commercial papers. Tether eased investor concerns by revealing that its commercial paper holdings have reduced from $20 billion to $8.5 billion over the previous quarter. Read more.

[FYI, commercial papers are short-term unsecured debt securities issued by corporations]

General Bytes Bitcoin ATMs hacked

Bitcoin ATM manufacturer, General Bytes’ ATMs were compromised due to a zero-day attack. Using the zero-day bug, hackers appointed themselves as default administrators for Bitcoin ATMs and redirected the destination wallet addresses to their wallets. Read more.

Scaramucci doesn’t view bitcoin as an inflationary hedge

The global investment management firm, Skybridge Capital CEO, Anthony Scaramucci recently argued that Bitcoin continues to be an attractive asset, however, it has not reached the “wallet bandwidth” required for it to get the status of an inflation hedge.

Meme of the day

Well, that's a wrap for today!

Have a good day. See you tomorrow! 👋🏽