Good Morning, Switchers 🌞

👋Welcome to Switch Daily.

Bitcoin turned 14 years old yesterday! 🥳And crypto Twitter was pouring birthday wishes to their favourite crypto. The attention was well-deserved coz ever since Bitcoin was first mined on 3rd Jan 2009:

It continues to maintain the status of ‘the largest crypto’.

The bitcoin network has been running relentlessly without any shutdowns since day 1.

And it has never been hacked.

Come to think of it, it feels like your firstborn turned 14 and has already achieved so much to make you super proud. 😌

BTW, if you like reading this newsletter, give us a shout-out on Twitter and get your friends to subscribe. It will mean a great deal to us!

Here’s what we’ve got for you today:

Market pulse

Recession is here or near?

Juicy bytes

Meme of the day

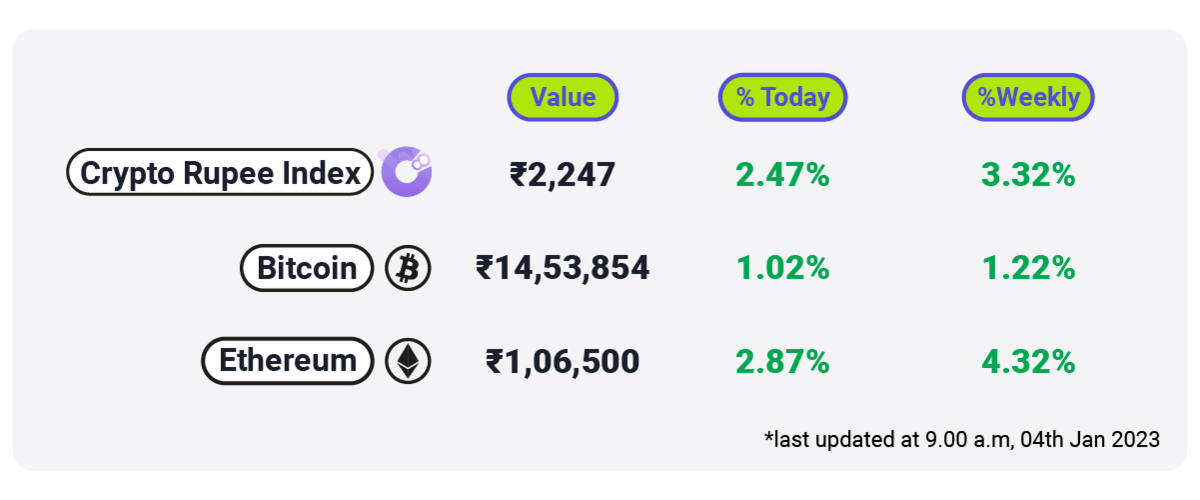

Market pulse 📈

The market is cheer-y 😎

The crypto market experienced a choppy session yesterday as the US markets reopened after the holidays. Investor concerns about the Fed policy put pressure on the NASDAQ Index, which fell by 0.76% and impacted the crypto market.

However, today most of the top cryptos are showing signs of recovery with BTC and ETH gaining. BNB and ADA are doing pretty well with 4.31% and 4.9% gains over the past 24 hours. The overall crypto market cap is also looking healthier with 1.55% gains since yesterday.

New Year, More Fear! 🥺

How long have we been in the bear market? A lifetime? Can we get it over with already?

Yep, we’d love to watch that happen. Our resolution for 2023 was to live to see the bull market kick in after all—not so much a resolution than a wish, we know. You get the feeling, don’t you?

But the IMF just threw a bucket of ice-cold water on that burning desire. Kristalina Georgieva, the chief of the International Monetary Fund (IMF), said that the new year is going to be tougher than 2022 on CBS’ news show. They are even expecting one-third of the world economy to be in recession soon.

Well, because three major global economies are slowing down simultaneously. Here’s what’s happening:

1. The United States - For most Americans, 2022 was a choppy year financially, as the S&P 500 sunk to its lowest levels since the 2008 financial crisis. As inflation rises and the Feds continue to raise interest rates, 2023 may not be looking so great.

2. The European Union - For most of the countries in Europe, 2022 has been a year of energy and climate crisis triggered majorly by the Ukraine war. In Oct 2022, the IMF revised global economic growth since the war was causing high inflation rates from central banks.

3. The Republic of China - As the coronavirus overwhelmed the healthcare system, dampening consumption and production, China's reversal of its extraordinarily strict COVID policy meant that economic activity in December fell to the slowest pace since February 2020. For the first time in 40 years, China’s growth in 2023 is likely to be at or below global growth.

Should we be worried?

We are still connected to the global economy at large, so if the world's largest economy—US suffers recession, there are chances for it to impact India to a certain extent.

However, IMF has projected a global growth rate of 2.7% in 2023, but has projected a growth rate of 6.9% for India. This is still higher than the rest of the world. Indian equity markets have begun to deviate from the global trend, becoming less sensitive to Fed rate hikes, US growth conditions, and FII selling.

The crypto market on the other hand is tied to the global economy at large. So, an impending recession could impact the crypto market and drag the bear market further. But since the market works in cycles, a bull market is inevitable once the economy bounces back. Until then, let’s practice caution, DYOR and HODL.

Note: None of this is financial advice, and we’re not financial advisors. We’re merely your fellow investors who share information on the go.

What’s hot? 🔥

Former FTX CEO Sam Bankman-Fried has pleaded not guilty to all criminal charges stemming from the crypto exchange's demise, including wire fraud, securities fraud, and violations of campaign finance laws.

The larger transaction volumes of Ethereum have continued into the new year, with the Ethereum transaction count on Jan. 2 reaching 924,614, a 300% increase over Bitcoin's 229,191 on the same day.

Solana (SOL) tokens have gained more than 8% over the past 24 hours and part of Solana's price recovery was due to increased interest among Solana community members in Bonk (BONK), a newly launched token themed around the shiba inu dog breed

Meme of the day!

Thank You,

See you later, folks. 👋

Loving Switch Daily? Make sure to share it with your friends and spread the love 💙