Good Morning, Switchers 🌞

👋Welcome to Switch Daily.

You asked, and we answered. Well, we took some time, though, but that’s only coz we wanted to get it right. Gah, okay, you don't want to be riddled on a Monday morning 😬. So, let's get straight down to business.

CoinSwitch went live with its Proof of Reserves on Friday. And it has all the details about:

Our Wallet Addresses

Custodial Services

Exchanges We Work With

Proof of Reserves and Liabilities Report

How Much Cash Do We Have?

Check this out for more details. And have a super duper week ahead! 🫡

BTW, if you like reading this newsletter, give us a shout-out on Twitter and get your friends to subscribe. It will mean a great deal to us!

Here’s what we’ve got for you today:

Market pulse

Ethereum Gas fees

Hot news bytes

Meme of the day

Market pulse 📈

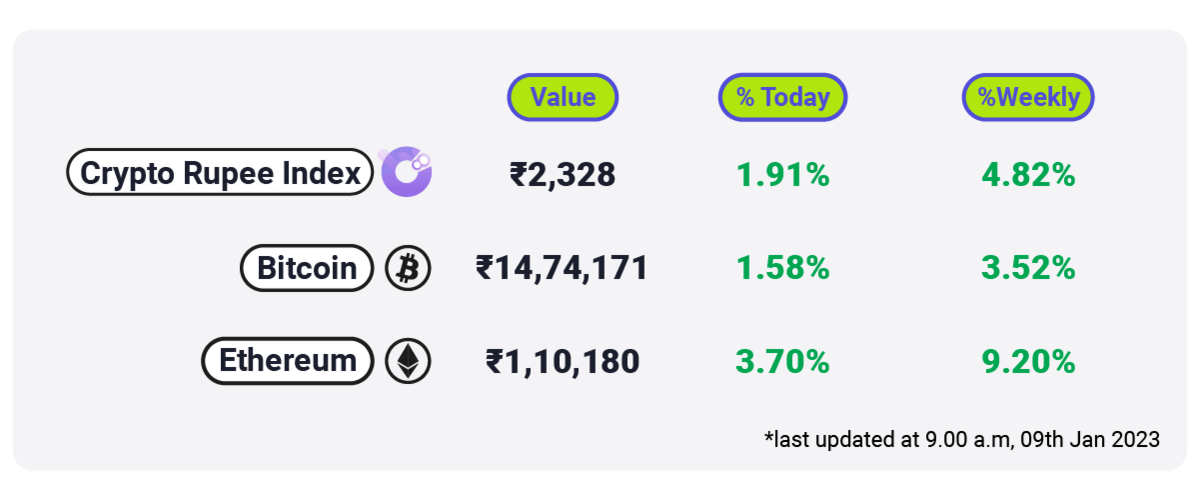

The market is green with glee 💚

It’s a positive start to the week as BTC and ETH have broken above their key resistance levels of $17K and $1,300. The total crypto market cap is now hovering close to $850 bn mark, an increase of 3% over the last day.

Top gainers among the top 10 cryptos include ADA, BNB, and MATIC, up by 19.64%, 7.1% and 6.8% respectively. Keep a check on how market reacts to Nasdaq later during the day.

What the Gas! ⛽

Go to any web3 meetup and there is a 100% chance that you will hear people complaining about how high the gas price on ethereum network is.

Here’s some good news for your developer friends—Latest reports suggest that Ethereum Gas price has fallen by over 19% in Dec 2022. Wohoo! 💃💃💃

Wait, but what difference does it make and how does it impact Ethereum? Before getting to the deeper details, lets first address the elephant in the room.

What is Ethereum gas fee?

Basically, Ethereum gas fees are the fees that you have to pay to execute a transaction or run a smart contract on the Ethereum blockchain.

How does it work?

When you want to send a transaction or run a smart contract, you have to specify how much "gas" you're willing to pay. The more gas you're willing to pay, the more likely it is that your transaction will go through.

Now, the gas fee is paid in gwei (one-billionth of ETH) and the cost of gas is determined by the market. It can go up or down based on how many people are using the network at any given time.

Why is gas fee suddenly falling?

The gas fee is majorly determined by the demand and supply of ETH. If demand decreases or supply increases, then there are chances for the gas fee to fall.

In early 2021, the Ethereum gas fee was very volatile especially when there was network traffic, mainly because the users had to guess how much fee they had to pay by themselves.

To regulate this chaos, Ethereum implemented ‘token burn’ —a mechanism where some percentage of ETH is destroyed permanently to reduce supply over time.

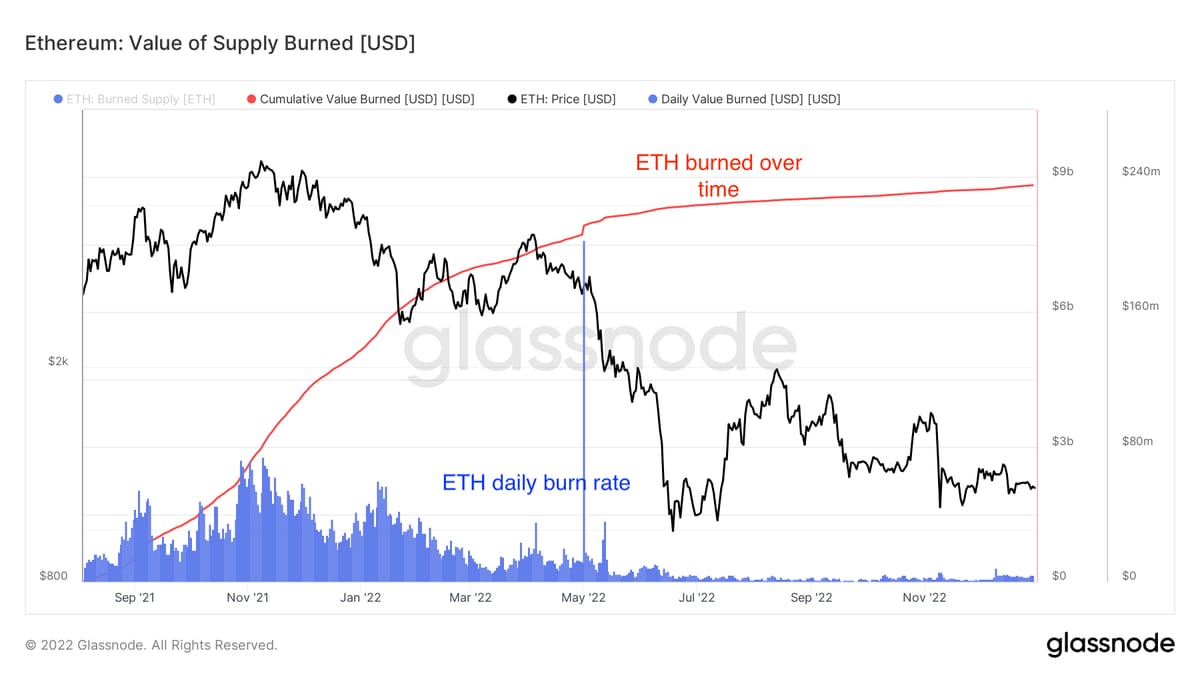

If you see this chart on Glassnode, you can make out that the amount of Ethereum burned daily has significantly reduced since May 2022 (Terra crash).

During the 2021 bull run, $20 million to $75 million in ETH was destroyed every day. In December 2022, this has dropped to around $2 million to $4 million in ETH burned per day. That means, the overall supply of Ethereum has peaked between this period. And when supply increases, gas fee reduces.

Another reason could be that, since Ethereum moved to Proof of Stake, the network has become quite faster, hence lesser waiting time for transactions to pass through. So, with a reduced waiting time, the users need not pay exorbitant fees to validators. Hence, low gas fees.

Does gas fee impact the price of ETH?

The Ethereum gas fee is typically paid in Ether (ETH), the native cryptocurrency of the Ethereum network. As such, the gas fee can have an impact on the price of ETH, but it’s quite complicated.

In general, low gas fee means fall in ETH value. But gas fee alone cannot be a good indicator of ETH price since there are other factors involved such as market conditions, regulatory developments, and technological innovations.

Note: None of this is financial advice, and we’re not financial advisors. We’re merely your fellow investors who share information on the go.

What’s making the headlines? 🗞

Cardano, saw its price surge to $0.33, a level not seen since November 19. Meanwhile, Solana, which began a remarkable run with an 11% increase in value on Monday, surged again Sunday to $16.04, territory it hasn't seen since Nov. 9, when it was in the midst of a 50% drop in three days.

According to Circle's most recent reserve report, US treasury bills account for approximately 65% of all USD Coin (USDC) reserves. Circle established its Reserve Fund on November 3 and transferred approximately 29.5% of its stablecoin reserves to the fund in less than a month.

According to a new press release from the US Department of Justice (DOJ), 31-year-old Gary Harmon of Cleveland, Ohio faces 40 years in prison for stealing digital assets from his brother that were initially seized by authorities.

Meme of the day!

Thank You,

See you later, folks. 👋

Loving Switch Daily? Make sure to share it with your friends and spread the love 💙