Good Morning, Switchers 🌞

👋Welcome to Switch Daily.

Happy Monday, you guys. In case you were busy living life over the weekend and hadn’t noticed the charts, we’ve got you covered, and guess what? We’re back on this brand new week with a cause for celebration. 🥳

The crypto market cap finally crossed the ‘$1 Trillion’ level over the weekend. 🔥

And why are we mooning over it? Well, this is the first time since November 2022, i.e., almost since the FTX crash incident, that the market cap has crossed $1 Trillion. This may not seem like a big deal coz the market has touched an ATH of $3 Trillion before, but trust us, small steps, bigger leaps. 🙌🏻

BTW, if you like reading this newsletter, give us a shout-out on Twitter and get your friends to subscribe. It will mean a great deal to us!

Here’s what we’ve got for you today:

Market pulse

BTC Bottom or Bull Trap?

Hot news

Meme of the day

Market pulse 📈

The market is surfing high 🌊

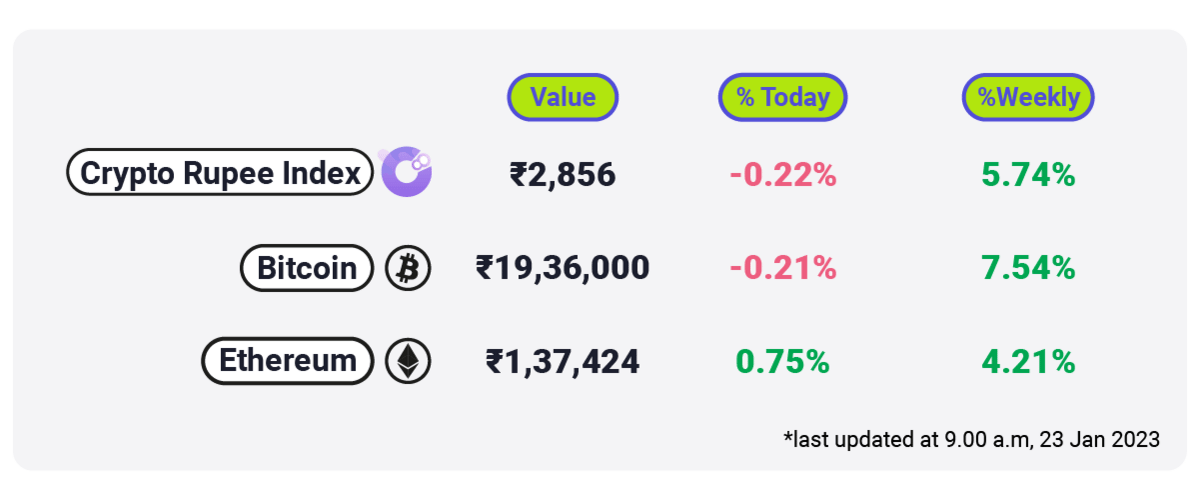

The crypto market recovered after it hit a pause over Fed rate fears. With most of the top cryptos trading in the green, the crypto market cap rose by $18.81 billion to end the day at $936.07 billion.

Among the gainers, XRP and ADA added 3.49% and 2.91%, respectively. BNB, DOGE, and ETH also found strong support, while BTC ended the session at $21,000 for the third time in four sessions.

Are we Bull Trapped?

Looks like our wishes to Santa last Christmas is finally taking shape. The crypto market has been behaving like nothing but a well-behaved perfect gentleman/lady at a fancy dinner party.

Coinmarketcap

Crypto prices began to rise earlier this month in anticipation of an economic report that showed December inflation cooled.

Over the past month:

The crypto market cap went from ~$800 Billion to $1 Trillion value.

BTC gained 35.08%, and ETH gained 34.09%.

The top ten crypto assets also gained an average of ~30%, with SOL giving huge returns of over 110%.

Great news, right? Well, yes for some and no for others. The crypto market is split between people who say that the Bitcoin Bottom is near and those who call this the Bull Trap.

BTC Bottom

A "bottom" in the context of Bitcoin refers to the lowest point that the value of the cryptocurrency reaches before starting to increase again. In simple terms, it is a low point in the price of Bitcoin. This can happen for various reasons, such as a decrease in demand or an increase in supply.

Or a Bull Trap? 🐮

A bull trap in trading is a situation where investors believe that the price of an asset is going to rise, but it actually falls instead.

This can happen due to false or misleading information, such as rumors or manipulated data, leading investors to buy into the asset at high prices. When the price starts to decrease, these investors may lose a significant amount of money.

Additionally, a bull trap can occur when there is a temporary price increase that does not indicate a true upward trend. This can lead investors to believe that a sustained uptrend is in place when in reality, it is not.

These situations can be created intentionally by manipulators in order to lure in uninformed investors and sell their own positions at a profit.

Is the price too good to be true? 🙈

Nobody knows yet. Even the analysts at JP Morgan could not identify the cause behind the surge in the value of crypto since the start of 2023. In their recent report, they stated:

“We don’t have a great answer on the January-to-date rally of crypto, but we do think it is emblematic of the underlying conviction many still have in cryptocurrencies.”

But whether it is a bull trap or the BTC bottom, we love the fact that our portfolios are green 🐸. In the long run, these things wouldn’t matter coz ‘Hodling’ is rewarding. However, we’d be cautious and take the DYOR route before making any investment decisions. How about you?

Note: None of this is financial advice, and we’re not financial advisors. We’re merely your fellow investors who share information on the go.

What else is trending? 📻

On Friday, a solo Bitcoin miner with a hashing power of only 10 TH/s (terahashes per second) won the race to add block 772,793 to the Bitcoin blockchain. Despite large pools becoming the dominant winners in Bitcoin mining, solo miners serve as a reminder of Bitcoin's probabilistic design.

According to a report from the Bank of America, at least 114 central banks are now investigating Central Bank Digital Currencies (CBDCs), representing 58% of all countries and generating 95% of global GDP, up from 35 in May 2020.

According to Whale Alert, whales are moving a total of 11,611 Bitcoin in three separate transactions valued at $240,675,134 at the time of writing. Three separate transactions are transferring a total of 332,194,839 XRP worth approximately $129,501,410 million.

Meme of the day

Thank You,

See you later, folks. 👋

Loving Switch Daily? Make sure to share it with your friends and spread the love 💙