Mornin’ Switchers!

Here’s your weekly dose of market news and updates.

When America sneezes, it seems the crypto world still catches a cold. Yet, even as the capital stress saga at Silvergate unfolds, investors’ immune systems appear to have triggered a response to the seasonal flu. Join us as we lift the lid on the latest crisis that has engulfed the crypto space.

Your weekly market roundup

The crypto market faces yet another crisis as Silvergate Capital, the influential banker to the crypto industry, stares at bankruptcy.

Silvergate saga!

It seems the crypto market is still reeling from the FTX collapse's contagion effect. Crypto-focused bank Silvergate Capital delayed the filing of its annual 10-K report last week. It cited the need for additional time from its auditing partners to complete certain audit procedures and answer certain regulatory and other inquiries.

Silvergate had earlier reported massive withdrawal pressure in the fourth quarter of 2022 in light of the FTX collapse.

In its filing, the bank also expressed concerns about the company's ability to continue as a going concern after losses from the sale of investment securities resulted in undercapitalization and failure to meet regulatory capital requirements.

Over the weekend, many leading crypto platforms, including Coinbase, Bitstamp, Gemini, Paxos, and Circle, terminated their association with SIlvergate. Also, Silvergate has terminated the Crypto Payments Network services.

Its aftermath sent shockwaves across the crypto market, sending the price of many top cryptocurrencies tumbling. BTC dropped below the supportive $22,500 level, and the total crypto market cap is now below the $1.02 trillion level.

*last updated 10:00 am, 6th March 2023

Risk-off sentiment on play

Furthermore, risk-off sentiment is at work, keeping the crypto market on a shaky ground.

As the US bond market's yield curve inversion continues to point to a recession in the second half of 2023, globally, investors seem to be turning to increasingly "risk-off" assets, building cash and short-term US treasury positions!

Sell-off in major L1 protocols

Heavy selling was witnessed in ETH competitors, as major Layer 1 protocol tokens saw a sharp correction. ADA was down 9%, SOL tumbled 9.56%, DOT lost 11.54%, ATOM forfeited 7.46%, and AVAX crumbled 13%. SOL, in particular, was again in focus after the Solana blockchain witnessed yet another outage. Even the recent pump in Polygon's MATIC token came under heavy selling pressure, correcting by 12% over the last week.

The other narrative that finally started losing steam and witnessed a sharp correction was the "Chinese Coins" or tokens/protocols that have a heavy China dominance in terms of developers and projects. Among them were Filecoin (FIL down by 12%), VeChain (VET down by 17%), and Neo (NEO down by 11%).

Hot off the press: Market developments in the news

News is one of the major drivers of the crypto ecosystem. Catch up on all the developments in the space with our quick takes on the latest developments.

Ethereum’s Shanghai upgrade pushed to early April

Ethereum core developers said the mainnet Shanghai upgrade will be delayed by about two weeks. The upgrade is now slated to be implemented in the first two weeks of April. The mainnet upgrade will be deployed about a fortnight after the Goerli testnet launches on 14 March. On 16 March, Ethereum core developers will meet to finalize the mainnet deployment schedule. (Source: Cointelegraph)

NFT sales zoom in February

NFT sales volume, which had been lagging for several months, rebounded sharply in February. According to data from DappRadar, NFT sales volume surpassed $2.04B in February, up by 117% from $941M in January, the highest since the Terra implosion. NFT marketplace Blur’s trading volume jumped over $1.13B in February, while Opensea recorded $587.22M in trading volume. (Source: Decrypt)

Ethereum deploys ERC-4337 standard

The Ethereum blockchain has implemented a feature known as "account abstraction," which is regarded as a key improvement that will make it easier for users to recover cryptos if they lose private keys to an online wallet. It is implemented using the new ERC-4337 standard. The contract can be used on all EVM chains, which means it can be deployed in any network that accepts EVM. (Source: Coindesk)

Yuga Labs joins Ordinals craze

Content: BAYC’s Yuga Labs has now joined the Ordinals mania with the launch of a new Bitcoin-based NFT collection. The TwelveFold collection comprises 300 generative art pieces. Since Bitcoin does not support NFTs by itself, Ordinals Theory protocol, which this collection relies on, will help store the NFTs on the blockchain. Each artwork will use 3D modeling. The auction will take place later this week. (Source: Coindesk)

Coinbase to suspend BUSD trading

Leading US-based crypto exchange platform Coinbase said it is suspending trading in BUSD, starting 13 March, as the stablecoin doesn’t meet its listing standards. However, users can access their BUSD holdings and withdraw them anytime. Earlier, the SEC had asked Paxos to stop minting BUSD stablecoin as it is an unregulated security. Following the development, BUSD steadily lost the market cap and currently has a circulating supply of $8.6 billion. (Source: Coindesk)

On-chain activity

Now let’s try to look to the future with some on-chain activity data analysis, shall we?

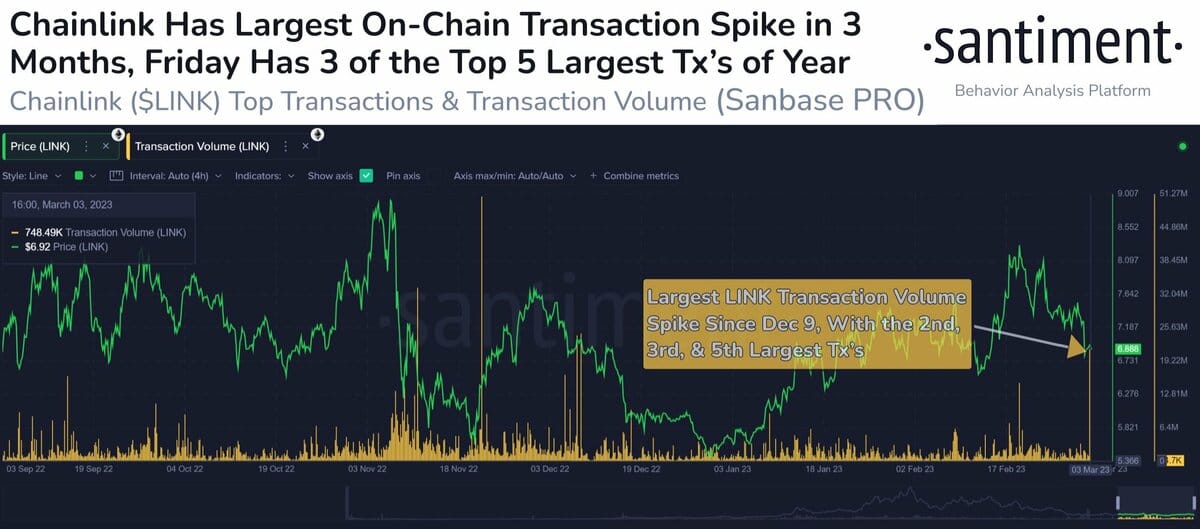

On Friday, three big whale transactions on Chainlink in a very short time were recorded, in which 11.6 million LINK tokens worth about $79.7 million was transferred to whale wallets.

Ahead of the Shanghai upgrade, the first major upgrade after the Merge, the exchange supply of ETH has fallen significantly and is at the lowest level in five years. Lower exchange supply reduces the chances of high volatility and lower future sell-off probability.

Chart of the week: MKR

Last week, MKR gave a breakout above the ₹66,500 level with strong trading volumes and has moved higher, breaking multiple resistance levels placed at ₹74,500 and ₹79,000. It is now attempting to break above the next highly resistive ₹85,000 level. Before moving higher, it may test for support at the ₹75,000 level. Also, RSI is near the 70 level, indicating the positive sentiment in the counter. As always, DYOR.Source: Tradingview

If you are new to charts, read our beginner’s guide to TradingView charts.

Coin of the week: SHIB

With Shiba Inu's core developers working on launching multiple ecosystems, such as the Shibarium layer 2 protocol, NFT-based games, and numerous other projects, SHIB is gradually shedding the memecoin label.

Also, as preparations for the Shibarium launch are nearing completion, SHIB is witnessing higher trading activity.

Last week, taking advantage of the dip in SHIB price, an Ethereum whale tagged as “BlueWhale0073” accumulated 131.4 billion SHIB tokens, worth about $1.48 billion in a single scoop.

SHIB burn rate has also spiked significantly to 754% in the last 24 hours, and to date, over 41% of the supply has been removed, according to SHIB’s burn portal.

Thanks for sticking around!

See you later, folks.

Loving Switch Weekly? Make sure to spread the love and hit share!