Hello, and welcome to the world of finance and crypto! Today we bring you an analysis of the latest developments from the cryptosphere, including the big BlackRock news, and of course, your weekly crypto crossword to help you ward off the Monday blues.

The first order of business, though, is to help plan your investments better. So let’s get started, shall we?

People learn from their own experiences, but wise folks learn from the experiences of others. We trust you to want to be the latter. So here’s bringing to you the story of yet another seasoned investor. You can watch it on CoinSwitch Money (or below).

This week on Money Moves, our Youtube series on the secrets of wealth creation, we bring you insights from startup founder Ravi Handa. Handa managed to retire at 39 with a corpus of over ₹12 crores! Listen up as our host Jayadevan PK talks to him about his incredible journey, and get set to make some rock-solid money moves!

We will keep highlighting such stories every week, so keep an eye on this section. For now, let’s roll in your weekly market update.

The slipping crypto market found a foothold when asset management firm BlackRock applied for a spot Bitcoin ETF registration on Thursday. That halted the downward trajectory that macro- (the Fed rate hike pause, specifically speaking) and industry-specific developments had set it on. The market thus ended the week in green with a market cap of over $1.1 trillion.

BTC’s price soared above the $26K level, lifting the broader market sentiment, too. Bitcoin’s dominance score also soared to a two-year high as it approached 50% of the total crypto market cap. This signals that investors are turning away from riskier altcoins.

As a result of these developments, some of the worst-hit large-cap cryptos were ADA, MATIC, and SOL. Each of them fell by over 20% last week. Thankfully, not every crypto was in for the same fate as the volatility stabilized towards the end of the week.

Also on a positive note, global crypto hubs continue to emerge. The news section below will fill you up on these developments.

The cryptos that witnessed some interesting price action over the last week were:

BTC: 2.12% ⏫ $26,417

BNB: 8.02% ⏫ $243

MKR: 11.14% ⏫ $687

ADA: 5.80% 🔽$0.26

(All data here is as of 12.15 pm, 19 June 2023.)

If you’re an investor, you must know what’s causing or might cause price action. Here’s some of the most important news in recent times to help you figure it out.

To prevent the freezing of its assets, Binance.US secured a truce with the Securities and Exchange Commission (SEC) in exchange for more transparency. Read more here.

Hong Kong’s regulatory body is pressuring banks to accept crypto exchanges as clients. Read more here.

Polygon Labs announced the launch of its 2.0 upgrades, which try to establish a Value Layer of the internet. The layer will make unlimited scalability and unified liquidity possible. Read more here.

Venturing outside the US for the first time, venture capital firm a16z is opening an offshore office in London. Read more here.

Gensyn, a provider of blockchain-based computing resources for AI platforms, secured $43M in a Series A funding round. Read more here.

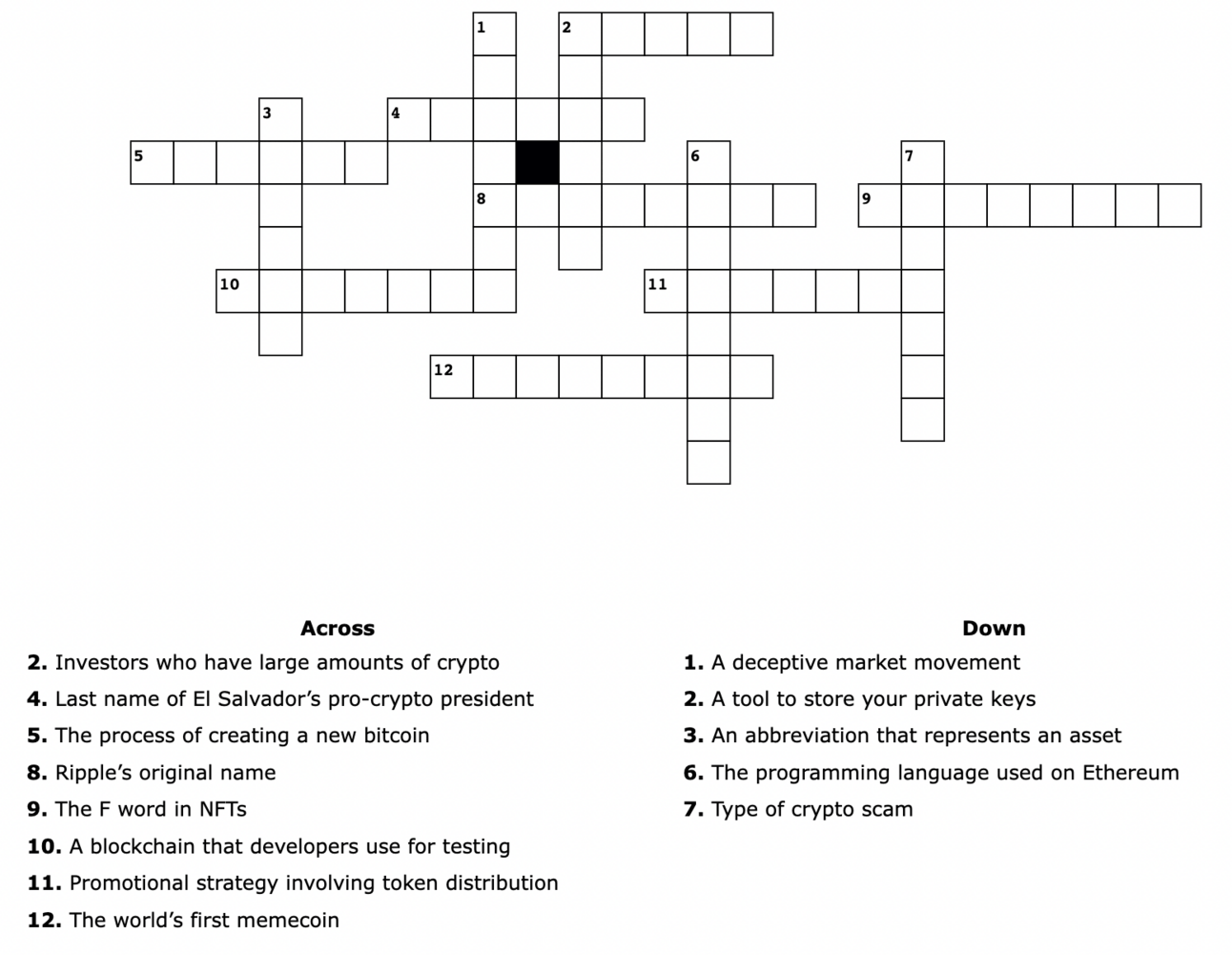

Before we conclude, we bring you a splash of fun with our crypto crossword. We hope you enjoy it!

That’s it for now. Thanks for sticking around.

See you later, folks!

Loving the newsletter? Make sure to spread the love and hit share!