Good Morning, Switchers 🌞

👋Welcome to Switch Daily.

The crypto market saw a massive sell-off on Tuesday as BTC failed to rise above the $23K level. The sell-offs are possibly due to profit taking. ETH, ADA, and DOGE witnessed the largest sell-offs, shedding 5.59%, 6.37%, and 6.78%, respectively, as a result. The total market cap fell by 3.3% to touch $1.02T. However, the Crypto Fear and Greed Index is steady at 51/100, and that’s a good sign.

Market pulse

Bitcoin Fear & Greed Index

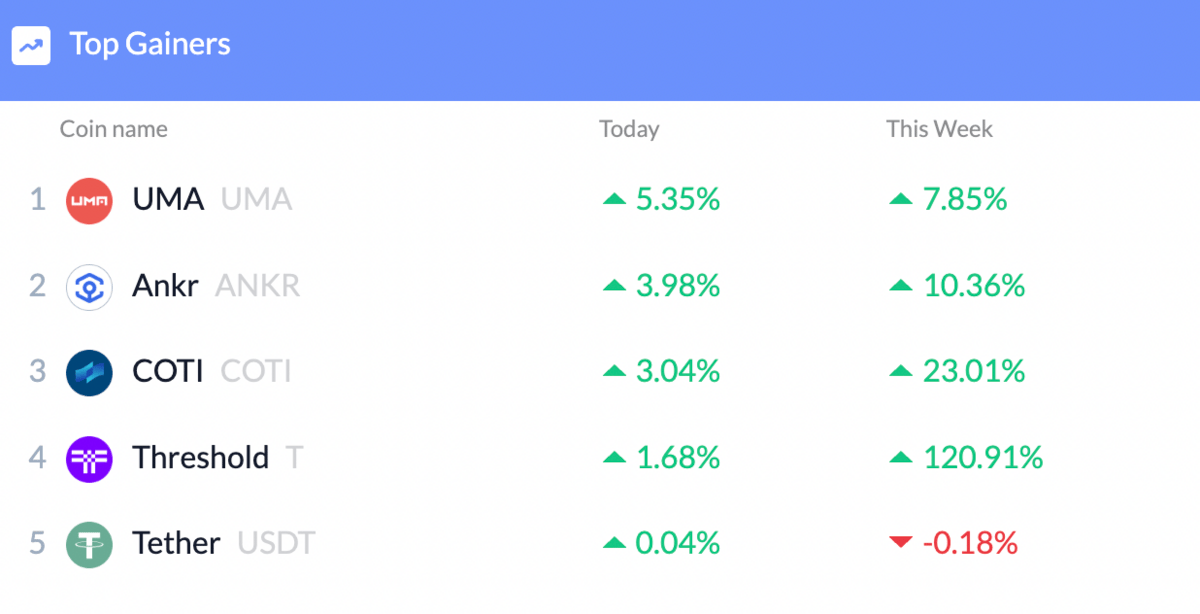

Top Gainers and Losers

What's in the news

Market pulse 📈

Bitcoin Fear & Greed Index

Today's Crypto Trends

*Last updated at 9:00 am, 25 January 2023

From the crypto news wires 📰

Genesis is hopeful that the company may settle its creditor disputes as soon as this week, according to a lawyer for the insolvent crypto lending company. The lawyer said that by the end of May, the firm might exit Chapter 11 proceedings. Genesis' attorney Sean O'Neal said this at an initial hearing at the United States Bankruptcy Court on 23 January. The news buoyed the crypto market yesterday.

NITI Aayog, India’s apex public policy think tank, announced the development of a blockchain module in partnership with the crypto-focused platform 5ire and Network Capital, a mentorship and career exploration platform. The initiative is run by the Atal Innovation Mission (AIM) of NITI Aayog, which operates Atal Tinkering Labs (ATL) in more than 10,000 schools across the country.

The adoption of cryptos reached a new milestone in 2022 with 425 million global users, according to research by Singapore crypto exchange Crypto.com. The data showed that 219 million people held Bitcoins in December, compared to 87 million who owned Ether. The exchange said the analysis is based on a mixture of on-chain data from Bitcoin and Ethereum, survey analysis, and its internal data.

Blockchain development platform QuickNode has closed a $60 million Series B funding round as part of its global expansion plan. The firm said 10T Fund, Tiger Global, Seven Seven Six, and QED participated in the round, which valued QuickNode at $800 million. The funding will support the company's international growth and accelerate the switch to Web3, according to the management.

Loving Switch Daily? Make sure to share it with your friends and spread the love 💙

Thank You,

See you later, folks. 👋

Loving Switch Daily? Make sure to share it with your friends and spread the love 💙